Home Slider

The Centers for Medicare and Medicaid Services (CMS) has been quite active this year implementing three new workers’ compensation Medicare set-aside (WCMSA) updates. CMS’s three new policies significantly change WCMSA compliance going forward. It is critical that workers’ compensation insurers, adjusters, attorneys, and other workers’ compensation claims, professionals understand these new changes as part of claims handling and settlement practices.

Toward this objective, the authors outline CMS’s three new WCMSA updates as follows:

Update #1

TPOC/WCMSA reporting now gives CMS greater visibility into WCMSA practices

Effective April 4, 2025, workers’ compensation Responsible Reporting Entities (RREs)1 must report several WCMSA data points regarding workers’ compensation settlements with Medicare beneficiaries reportable as TPOCs through CMS’s Section 111 TPOC reporting process.2 This new requirement only applies to workers’ compensation settlements with Medicare beneficiaries.

In general, under CMS’s new process, RREs must report the following five required data points to CMS as part of its TPOC report: (a) WCMSA amount, (b) WCMSA period; (c) WCMSA funding method (lump sum or annuity), (d) initial deposit amount, and (e) anniversary (annual deposit amount).3 In addition to these “required” data points, the WCMSA case control number and professional administrator employer identification number (EIN) are “optional” fields the RRE may report if it so elects.4 This new reporting requirement is prospective and only applies to Section 111 coverage reports with TPOC dates of April 4, 2025, or later.5

The scope of CMS’s TPOC/WCMSA reporting requirement is significant. For example, RREs must report the required data points whether or not the WCMSA is submitted to CMS for approval as part of the agency’s voluntary $25,000 WCMSA review threshold pertaining to Medicare beneficiaries,6 as well as for non-submit MSAs, evidenced-based MSAs (EBMSAs), or other similar arrangements involving settlements with Medicare beneficiaries that meet CMS’s review threshold, but that are not submitted to CMS for approval.7

In addition, and significantly, reporting is also required regarding WC settlements with Medicare beneficiaries that do not meet CMS’s WCMSA $25,000 review threshold (often referred to as “low dollar” or “non-threshold” settlements), as well as situations where ongoing responsibility for medicals (ORM) continues for some injuries associated to the claim but not others.8 Reporting is also required regardless of the WCMSA amount.9 In essence, any allocation of funds related to Medicare covered post-settlement medical care agreed upon via settlement must be reported.

Of note, CMS’s new TPOC/WCMSA reporting requirement also applies in situations where no WCMSA is included as part of a settlement with a Medicare beneficiary. In this instance, a $0 MSA value must be reported. While CMS will accept TPOC data with the MSA amount reported as $0, it is important to note that CMS reserves the right to audit $0 dollar value submissions if it suspects cost-shifting to Medicare may have occurred.10 Further, CMS has stated it reserves all potential recourses in instances of noncompliance with its new TPOC/WCMSA reporting requirements, including possible False Claims Act actions.11

Regarding how CMS will use the reported data points, CMS will mark the Medicare “Common Working File” (CWF) with a WCMSA MSP record if the TPOC includes a WCMSA. If a WCMSA MSP record exists, CMS notes that this represents that WCMSA funds are available to pay primary and Medicare may appropriately deny payment for treatment related to the workers’ compensation injury and settlement until the funds are exhausted.12 Also, upon creation of a CWF WCMSA record, CMS notes that it will send notification to the claimant outlining the process for WCMSA attestation and exhaustion.13

In the big picture, CMS’s TPOC/WCMSA reporting process is significant as it gives CMS unprecedented visibility into the use (and non-use) of WCMSA arrangements. The fact that non-submit MSAs and EBMSAs must also be reported is noteworthy, as CMS has lacked the ability to identify or track non-CMS approved MSAs up until this point.14 CMS will also have, as noted above, visibility into low dollar settlements ($25,000 or less) with Medicare beneficiaries. On this latter point, insurers may wish to review their compliance practices to determine if a WCMSA should be included as part of these settlements. As part of this, keep in mind that CMS has long stated that its future medicals interests must still be considered even in situations where a settlement with a Medicare beneficiary does not meet its voluntary $25,000 WCMSA review threshold.15 In addition, the fact that CMS reserves the right to audit $0 MSA values is another important consideration going forward in general, and, more specifically, in relation to CMS’s new $0 WCMSA policy effective July 17, 2025 as discussed more fully in Update #3 below.

From a compliance standpoint, Verisk offers several services to help insurers stay compliant with CMS’s new TPOC/WCMSA requirement. Our new MSA Link service is designed to facilitate adjuster compliance with an insurer’s WCMSA protocols for WC settlements with Medicare beneficiaries greater than $25,000. For low dollar settlements, our Data-Driven MSA is a new tool that automates calculation of a WCMSA using the claim’s data to determine an appropriate allocation while leveraging Verisk’s vast medical, legal, and data science experience, in conjunction with our claims data sources. Finally, our Under Threshold MSA service is another allocation option for low-dollar settlements.

Update #2

New Amended Review changes may help reduce WCMSAs

Effective April 7, 2025, CMS now allows parties to submit Amended Review requests at any time after a WCMSA case is approved by CMS.16 This new CMS update eliminates the agency’s prior policy that required parties to wait one-year from when CMS approved a WCMSA proposal to file an Amended Review request.

Briefly, CMS’s Amended Review process allows parties a one-time request to submit new medical documentation to adjust a prior WCMSA approval for cases meeting the Amended Review requirements outlined below.17 As part of this process, a new WCMSA proposal may be submitted to CMS aimed at reducing a prior CMS WCMSA approval.

With removal of the one-year waiting period, CMS’s updated Amended Review criteria is as follows: (a) CMS has issued a conditional approval/approved amount; (b) The case has not yet settled as of the date of the request for re-review; and (c) Projected care has changed so much that the submitter’s new proposed amount would result in a 10% or $10,000 change (whichever is greater) in CMS’s previously approved amount.18

If the above criteria is met, CMS “will permit a one-time request for re-review in the form of a submission of a new cover letter, all medical documentation related to the settling injury(s)/body part(s) since the previous submission date, the most recent six months of pharmacy records, a consent to release information, and a summary of expected future care.”19 If CMS approves the Amended Review request, “the new approved amount will take effect on the date of settlement, regardless of whether the amount increased or decreased.”20

From a practical claim perspective, determining which cases may be ideal for Amended Review is important. In this regard, typical, and non-exhaustive examples, include situations where surgeries or procedures for implanted devices have occurred after the original WCMSA approval, the claimant’s treatment has stabilized or reduced, changes or reductions in medication have resulted in less monthly spend, and there has been a reduction in reserves over time.21

Overall, from the author’s view, CMS’s decision to eliminate the prior one-year waiting period is a helpful change to the Amended Review process as parties can now can quickly respond to an WCMSA counter-higher with new supporting documentation and mitigate additional costs while a claim remains open pending settlement. On this point, parties interested in Amended Review may wish to consider Verisk’s MSA Second Look service which can help you help you leverage CMS’s Amended Review process. In 2024, our MSA Second Look service delivered $4.4 million in client savings, with total client savings exceeding $55 million since CMS implemented its Amended Review program back in 2017.

Update #3

Navigating CMS’s new $0 WCMSA landscape

Effective July 17, 2025, CMS will no longer accept or review $0 WCMSA submissions as part of its WCMSA review/approval process.22 After this date, the parties may still use $0 WCMSAs, but they will need to independently determine whether a $0 WCMSA is appropriate based on the parameters outlined by CMS in Section 4.2 of the WCMSA Reference Guide.

By way of brief background, a $0 WCMSA, in general, is typically utilized in scenarios where a workers’ compensation (WC) settlement does not reflect compensation for the need for future medical treatment related to the claim and, as such, no money is set aside from the WC settlement to pay for Medicare covered claims related treatment post-settlement. Historically, for settlements meeting CMS’s WCMSA review thresholds, the parties could choose to submit a $0 WCMSA proposal to CMS for review and approval.23 If CMS approved the $0 WCMSA proposal, this indicated that CMS agreed that its interests were protected.24

However, effective July 17, 2025, parties will no longer be able to secure CMS’s approval of a $0 WCMSA and must instead rely on independently determining whether a $0 WCMSA is appropriate. In this regard, CMS states that “[e]ntities should consider [CMS’s] parameters in determining whether a zero-dollar WCMSA allocation is appropriate and maintain documentation to support that allocation” as outlined by CMS in Section 4.2 of the WCMSA Reference Guide.

As noted above, CMS outlines the conditions regarding when a $0 WCMSA may be appropriate in Section 4.2 which can be viewed here.

If any of the applicable conditions set-forth in Section 4.2 are met, then CMS states that “[a] WCMSA is not necessary … because when they are true, they indicate that Medicare’s interests are already protected.”25 Keep in mind, as noted above, if a $0 WCMSA is applicable, CMS states that parties should “maintain documentation to support that allocation.”26 Further, maintaining supporting documentation is also important since, as discussed in Update #1 above, CMS reserves the right to audit $0 MSA values reported as part of the TPOC/WCMSA reporting process if it suspects cost shifting to Medicare may have occurred.27

Of note, in situations where CMS’s outlined parameters are not met, CMS states that its “voluntary, yet recommended, WCMSA amount review process is the only process that offers both Medicare beneficiaries and Workers’ Compensation entities finality, with respect to obligations for medical care required after a settlement, judgment, award, or other payment occurs.”28

CMS’s decision to sunset its $0 WCMSA approval process should not prevent parties from continuing to leverage $0 WCMSAs to settle workers’ compensation claims when appropriate and applicable. The key is understanding and documenting the bases for inclusion of a $0 WCMSA, which may also prove helpful in the event CMS decides to audit or question the inclusion of a $0 WCMSA in a particular claim. Verisk can assist parties by providing an independent third-party review, analysis, and assessment regarding whether a $0 WCMSA may be applicable and documenting $0 WCMSAs as part of the settlement.

Going Forward

As the above updates suggest, WCMSAs remain a focal point for CMS, and it is critical that CMS’s changes are understood and incorporated into claims handling and settlement practices going forward. In this regard, it may be a good to assess current practices to determine if adjustments to WCMSA best practices and protocols may be necessary.

Mark’s Bio:

Mark Popolizio, J.D., is the Vice President of MSP Compliance for Verisk Casualty Solutions. He has been a nationally recognized thought leader in Medicare Secondary Payer (MSP) compliance since 2001. Mark practiced insurance defense litigation for ten years concentrating on the areas of workers’ compensation and general liability. As of 2006, Mark has dedicated his focus exclusively to MSP compliance working with carriers, self-insured, TPAs and other claims professionals in addressing MSP compliance issues. Mark is a regularly featured presenter on MSP issues at national seminars and other industry events – and has authored numerous national articles addressing several topics related to MSP matters. In addition, Mark has released several articles on Third-Party Litigation Funding issues. Mark is also active with several industry groups. Mark is licensed to practice law in Florida and Connecticut.

Sid’s Bio:

Sid Wong is the Vice President of Policy at Verisk Casualty. In this capacity Sid monitors and evaluates the changing state of Medicare Secondary Payer compliance to develop impactful solutions to emerging MSP issues and works to ensure that Verisk’s Casualty’s policies, products, and services continue to align with the MSP landscape. He also oversees Verisk Casualty’s policy team, which provides policy and compliance support for all of Verisk Casualty’s clients. During his tenure he has served as Legal Director, Assistant Director of Services, Client Solutions Manager, and MSP Compliance Manager. Sid is a subject matter expert on MSAs, Conditional Payment Recovery, and Section 111 reporting. He collaborates with clients to develop best practices and respond to any compliance or policy questions, whether it is a case level issue or evaluating a process impacting the larger organization. He regularly presents at industry conferences and provides training for clients.

Prior to joining Verisk Casualty, Sid worked for a small general practice firm in New Hampshire where he received his JD from the University of New Hampshire Franklin Pierce School of Law. Sid is a member of the MA, NH, and NY bar, the IAIABC, NAMSAP, MARC, and is MSCC certified.

- Briefly, the party responsible for reporting under Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA) (P.L. 110-173) is called the “Responsibility Reporting Entity (RRE).” See, CMS’s Section 111 NGHP User Guide, Chapter III, Version 8.0, April 7, 2025, Chapter 6. In general, RREs are insurers and self-insurers but could involve other risk-bearing entities such as self-insurance pools or assigned claims funds depending on the facts. Id. On this point, CMS states as follows: “42 U.S.C. § 1395y(b)(8) provides that the ‘applicable plan’ is the RRE and defines ‘applicable plan’ as follows: ‘APPLICABLE PLAN—In this paragraph, the term ‘applicable plan’ means the following laws, plans, or other arrangements, including the fiduciary or administrator for such law, plan, or arrangement: Liability insurance (including self-insurance), No-fault insurance, [and] Workers’ compensation laws or plans.” CMS’s Section 111 NGHP User Guide, Chapter III, Version 8.0, April 7, 2025, Chapter 6, Section 6.1. ↩︎

- Very generally, “TPOC” is the abbreviation for “total payment obligation to the claimant.” Very generally, and in part, CMS describes TPOC as follows: “The Total Payment Obligation to the Claimant (TPOC) refers to the dollar amount of a settlement, judgment, award, or other payment in addition to or apart from ORM. A TPOC generally reflects a ’one-time’ or ’lump sum’ settlement, judgment, award, or other payment intended to resolve or partially resolve a claim. It is the dollar amount of the total payment obligation to, or on behalf of the injured party in connection with the settlement, judgment, award, or other payment. Individual reimbursements paid for specific medical claims submitted to an RRE, paid due RRE’s ORM for the claim, do not constitute separate TPOC Amounts. The TPOC Date is not necessarily the payment date or check issue date. The TPOC Date is the date the payment obligation was established. This is the date the obligation is signed if there is a written agreement unless court approval is required. If court approval is required, it is the later of the date the obligation is signed or the date of court approval. If there is no written agreement it is the date the payment (or first payment if there will be multiple payments) is issued. Please refer to the definition of the TPOC Date and TPOC Amount in Fields 80 and 81 of the Claim Input File Detail Record in the NGHP User Guide Appendices Chapter V.” See generally, CMS’s Section 111 NGHP User Guide (Version 8.1, May 5, 2025), Chapter III, Chapter 2, and Section 6.4. Under CMS’ current TPOC reporting thresholds, physical trauma WC settlements greater than $750 are required to be reported under the Section 111 reporting process. The $750 threshold does not apply to settlements involving exposure, ingestion, or implantation cases. See generally, CMS’ Section 111 NGHP User Guide (Version 8.1, May 5, 2025), Chapter III and IV, Section 6.4.4. ↩︎

- See CMS’s February 23, 2024 Alert and CMS’s Section 111 NGHP User Guide (Version 8.0, April 7, 2025), Chapter V, Appendix A. ↩︎

- Id. ↩︎

- See CMS’s Section 111 NGHP User Guide (Version 8.0, April 7, 2025), Chapter III, Section 6.5.1.1. As part of this section, CMS states, in pertinent part, “For workers’ compensation records submitted on a production file with a TPOC date on or after April 4, 2025, Workers’ Compensation Medicare Set-Aside Arrangements (WCMSAs) must be reported.” Id. See also, CMS Alert (February 23, 2024), Medicare Secondary Payer (MSP) Mandatory Reporting Provisions Section 111 of the Medicare, Medicaid, and SCHIP Extension Act (MMSES) of 2007, Technical Change Alert: Change to Workers’ Compensation Reporting. See, CMS’s February 23, 2024 Alert. ↩︎

- CMS’s TPOC/WCMSA Webinar (November 13, 2023). In addition, as part of its February 2024 Alert, CMS states, in pertinent part, that “[a]s previously discussed at the webinar held on November 13, 2023, CMS will be expanding the existing S111 reporting process to capture WCMSA information on all Workers’ Compensation (WC) claims involving Medicare beneficiaries that report settlement (i.e., TPOC). (author’s emphasis). See, CMS’s February 23, 2024 Alert.

Regarding CMS’s “$25,000 WCMSA review threshold,” CMS states as follows in its WCMSA Reference Guide: “CMS will review a proposed WCMSA amount when the following workload review thresholds are met: The claimant is a Medicare beneficiary, and the total settlement amount is greater than $25,000.00.” CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 8.1 (CMS’s emphasis). In terms of what constitutes the “total settlement amount,” CMS directs the reader to Section 10.1: Section 05 – Cover Letter (E. Settlement Details), which can be viewed here. ↩︎ - CMS’s TPOC/WCMSA Webinar (November 13, 2023). See also, CMS’s Section 111 NGHP User Guide (Version 8.0, April 7, 2025), Chapter III, Section 6.5.1.1 and CMS’s February 23, 2024 Alert. ↩︎

- CMS’s TPOC/WCMSA Webinar (November 13, 2023). ↩︎

- Id. ↩︎

- CMS’s TPOC/WCMSA Question and Answer Session, April 25, 2024. ↩︎

- CMS’s TPOC/WCMSA Webinar (April 16, 2024). ↩︎

- CMS’s Question and Answer Session (April 25, 2024). In addition, CMS has stated that once the WCMSA funds are exhausted and Medicare is made aware, the marker may be removed along with the associated restrictions on Medicare payments. Additionally, CMS has indicated that it plans to develop specific guidelines for reviewing situations where the MSA Amount is reported as $0 which, per CMS, will likely be prompted by what it termed as “a clear indication” that a lack of funding for future medicals appeared to be inappropriate. Id. CMS also suggested that, in this situation, it could decide to pursue recovery and apply a WCMSA (“W”) record to CWF upon that further review. Id. Further, CMS stated that it reserves the right to review/audit these types of submissions and suggested that it might identify scenarios where it feels there is an inappropriate lack of consideration/funding for future medicals as part of a WCMSA. Id. ↩︎

- CMS’s TPOC/WCMSA Webinar, April 16, 2024. ↩︎

- In this regard, it remains to be seen whether CMS will use this new reporting process to scrutinize or question these arrangements per Section 4.3 of CMS’s WCMSA Reference Guide. On this point, in Section 4.3 of the WCMSA Reference Guide CMS states, in part, that it views “the use of non-CMS-approved products as a potential attempt to shift financial burden by improperly giving reasonable recognition to both medical expenses and income replacement” and that it “may at its sole discretion deny payment for medical services related to the WC injuries or illness, requiring attestation of appropriate exhaustion equal to the total settlement as defined in Section 10.5.3 of this reference guide, less procurement costs and paid conditional payments, before CMS will resume primary payment obligation for settled injuries or illnesses, unless it is shown, at the time of exhaustion of the MSA funds, that both the initial funding of the MSA was sufficient, and utilization of MSA funds was appropriate. This will result in the claimant needing to demonstrate complete exhaustion of the net settlement amount, rather than a CMS-approved WCMSA amount.” WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 4.3. While CMS did clarify that it may consider and accept evidence that an EBMSA or a non-submit MSA funding was sufficient, it has not provided any metrics or guidance regarding how that is evaluated. ↩︎

- CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 8.1. In this regard, CMS in Section 8.1 states, in part, that its “[WCMSA review] thresholds are created based on CMS’s workload and are not intended to indicate that claimants may settle below the threshold with impunity. Claimants must still consider Medicare’s interests in all WC cases and ensure that Medicare pays secondary to WC in such cases.” Id. As part of this section, CMS also indicates that its review thresholds are considered as “workload management tool[s] and not…substantive dollar or ‘safe harbor’ threshold[s].” Id. On this point, CMS provides the following example regarding a settlement with Medicare beneficiary that does not meets is $25k WCMSA review threshold: “Example 1: A recent retiree aged 67 and eligible for Medicare benefits under Parts A, B, and D files a WC claim against their former employer for the back injury sustained shortly before retirement that requires future medical care. The claim is offered settlement for a total of $17,000.00. However, this retiree will require the use of an anti-inflammatory drug for the balance of their life. The settling parties must consider CMS’ future interests even though the case would not be eligible for review. Failure to do so could leave settling parties subject to future recoveries for payments related to the injury up to the total value of the settlement ($17,000.00).” CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 8.1. ↩︎

- CMS announced this change as part of an Alert released in January 2025. In this Alert, CMS stated, in pertinent part, as follows: “Amended Reviews: Currently, amended review requests cannot be submitted until one year after a WCMSA case has been approved. Effective April 7, 2025, amended review requests will be allowed at any time after a WCMSA case is approved.” Id. ↩︎

- WCMSA Reference Guide (Version 4.3, April 7, 2025), Chapter 16.3. ↩︎

- Id. ↩︎

- Id. ↩︎

- Id. ↩︎

- Of note, CMS in Section 16.3 of its WCMSA Reference Guide provides information regarding specific instances which may not qualify for Amended Review. For example, CMS states that “the approval of a new generic version of a medication by the Food and Drug Administration does not constitute a reason to request an amended review for supposed changes in projected pricing.” WCMSA Reference Guide (Version 4.3, April 7, 2025), Chapter 16.3. ↩︎

- On this point, CMS states: “Effective July 17, 2025, CMS will no longer accept or review WCMSA proposals with a zero- dollar ($0) allocation. Entities should consider the above parameters in determining whether a zero-dollar WCMSA allocation is appropriate and maintain documentation to support that allocation.” CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 4.2. Regarding the noted “above parameters,” these are outlined in full in the body of the article as part of this section addressing CMS’s $0 WCMSA changes. ↩︎

- CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Sections 4.2 and 8.0 which state, in part, the CMS’s WCMSA review, and approval process is voluntary. ↩︎

- In this regard, CMS states, the following in Section 4.1 of the WCMSA Reference Guide: “An individual or beneficiary may consider seeking CMS approval of a proposed WCMSA amount for a variety of reasons. The primary benefit is the certainty associated with CMS reviewing and approving the proposed amount with respect to the amount that must be appropriately exhausted. It is important to note, however, that CMS approval of a proposed WCMSA amount is not required.” CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 4.1. (Authors’ emphasis). Further, CMS in Section 4.2 states, in pertinent part, that “[w]hen CMS reviews and approves a proposed WCMSA amount, CMS stands behind that amount. Without CMS’s approval, Medicare may deny related medical claims or pursue recovery for related medical claims that Medicare paid up to the full amount of the settlement, judgment, award, or other payment.” See e.g., CMS’s WCMSA Reference Guide (Version 4.2, January 17, 2025), Section 4.2 As result, there is often significant benefit to receiving CMS’s approval. See e.g., CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 4.1 and 4.2. ↩︎

- Id. ↩︎

- CMS’s WCMSA Reference Guide (Version 4.2, January 17, 2025), Section 4.2. ↩︎

- CMS’s TPOC/WCMSA Question and Answer Session, April 25, 2024. ↩︎

- CMS’s WCMSA Reference Guide (Version 4.3, April 7, 2025), Section 4.2. On this point, CMS states in full as follows: “In instances where the above conditions are not met, CMS’ voluntary, yet recommended, WCMSA amount review process is the only process that offers both Medicare beneficiaries and Workers’ Compensation entities finality, with respect to obligations for medical care required after a settlement, judgment, award, or other payment occurs. When CMS reviews and approves a proposed WCMSA amount, CMS stands behind that amount. Without CMS’ approval, Medicare may deny related medical claims, or pursue recovery for related medical claims that Medicare paid up to the full amount of the settlement, judgment, award, or other payment.” Id. ↩︎

Each year, WCI brings in a Celebrity Keynote Speaker who sets the tone for the conference, provides meaningful and inspirational messages, and offers practical tools for personal and professional development.

WCI is honored to have Mark Schulman as our Celebrity Keynote Speaker!

Meet Mark Schulman

Mark is a first-call drummer known for his work with legends like P!NK, Cher, Billy Idol, Foreigner, Stevie Nicks and many other world-class performers. Mark combines insider rockstar stories, thrilling drum sequences, and actionable attitude techniques that show people how to harness their own rockstar DNA.

“When someone is a top performer in their field, or we see a team of top performers, people often refer to them as rockstars. But imagine what your team can learn about managing performance, energy, sustainability, and mental fitness from REAL rockstars? As someone who has played with some of the greatest pop and rock stars in the world for 32 years as their drummer, I have analyzed and studied the band dynamic relentlessly. Rockstar performers all share traits that got us to the top and KEEP us there.” – Mark Schulman

“When someone is a top performer in their field, or we see a team of top performers, people often refer to them as rockstars. But imagine what your team can learn about managing performance, energy, sustainability, and mental fitness from REAL rockstars? As someone who has played with some of the greatest pop and rock stars in the world for 32 years as their drummer, I have analyzed and studied the band dynamic relentlessly. Rockstar performers all share traits that got us to the top and KEEP us there.” – Mark Schulman

Joining the WCI Palooza Lineup

“WCI wanted to find a speaker who fits into our conference theme, WCI Palooza – The Comp Stars Are All Here, and who will energize and inspire our attendees to achieve new heights; and we found it in Mark. I think our attendees will come away with a new level of confidence in what they can perform after they hear Mark share the secretes of rockstar performance.”

– Andrew Sabolic, WCI’s Executive Director

Mark’s keynote will be part of the Opening Session on Monday, August 18. Don’t miss it!

Keynote Sponsor:

Get ready to amp up the excitement at this year’s WCI Conference! We’re bringing the energy straight to you with an unforgettable performance from the one and only Big & Rich – one of the most dynamic duos in music today!

Our beloved Monday Night Reception on August 18, promises to be a night of high-energy music and a whole lot of fun as Big & Rich bring their chart-topping hits to life in a performance you won’t want to miss. From “Save a Horse (Ride a Cowboy)” to “Comin’ to Your City”, these country music legends are ready to make this a night to remember.

“We’re all about bringing the best to our attendees, and Big & RIch are about to crank the energy up to 11 on the WCI Stage! Their performance is going to be off the charts – electric, packed with epic moments, and guaranteed to have everyone singing, dancing, and having a blast. Let’s make some lasting memories with our fellow workers’ comp stars!

– Andrew Sabolic, WCI’s Executive Director

Familiarize yourself with Big & Rich’s iconic hits by streaming them on Spotify or wherever you listen to music. Get ready to sing along when they take the stage at WCI!

Familiarize yourself with Big & Rich’s iconic hits by streaming them on Spotify or wherever you listen to music. Get ready to sing along when they take the stage at WCI!

One of the pillars of WCI is its chartable-giving initiatives. Give Kids The World and Kids Chance of Florida remain the focus of our philanthropic efforts, however due to the success of our annual conference WCI is expanding its giving to other charities who help those who are in need.

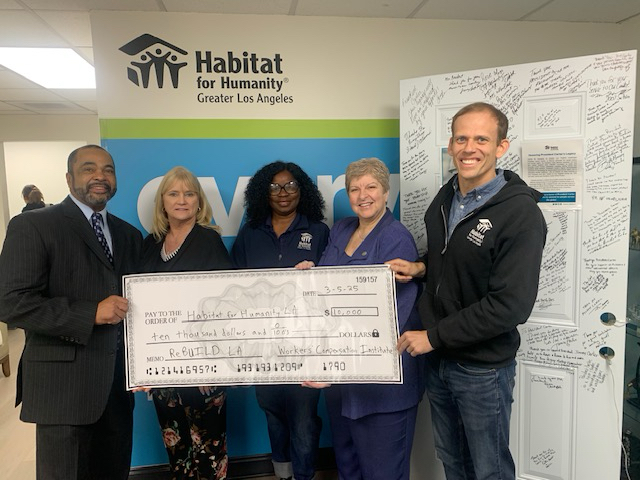

Helping Rebuild LA After the Wildfires

WCI has donated $10,000 to Habitat for Humanity Los Angeles. WCI’s Executive Director, Andrew Sabolic shared, “The wildfires destroyed thousands of homes and the impact on families and individuals who lost their homes is immeasurable. We are honored to play a small role in Habitat for Humanity’s rebuilding efforts.”

Pictured left to right are:

- Scotty Benton, VP Workers’ Compensation Practice, Sedgwick (representing WCI)

- Erin Rank, President & CEO, Habitat for Humanity LA

- Dr. Dinesa Thomas-Whitman, SVP of Programs & Government Relations, Habitat for Humanity LA

- Caryn Siebert, VP Carrier Engagement, Gallagher Bassett (representing WCI)

- Chris Untiet, Director of Community Relations, Habitat for Humanity LA

How Habitat LA is Making an Impact

Homeownership is the core of Habitat LA! They offer a hand-up, not a hand-out, to low-income families looking to buy a home. Homes are sold to qualifying families and financed with affordable homes loans in addition to the owners’ sweat equity of approximately 500 hours. Each year, Habitat LA also partners with low-income homeowners to provide critical health and safety repairs to the interior and exterior of their homes.

“This generous donation from Workers’ Compensation Institute comes at a critical time as we work to rebuild LA. One of our first projects will be to rebuild an Altadena home built by Habitat in 2023 and destroyed in the January 2025 fire. We have several ongoing fire related projects involved in the ReBUILD LA Wildfire Recovery Fund and appreciate the support and building bridges with organizations like WCI, Gallagher Bassett and Sedgwick” said Chris Untiet, Director of Community Relations.

Providing Comfort to Families in Need

In addition to funds from WCI, Gentle Bear (actually a dozen Gentle Bears) were donated by Gallagher Bassett. After explaining the origins of Gentle Bear and the significance of care and compassion and combatting PTSD, Mr. Untiet commented, “We will be passing the Gentle Bears out to children impacted by the fires at our wildfire relief distribution event in March. In a time of much anxiety and sadness we are sure their new snuggly and supportive friend will provide some hope and comfort.”

Coming Together to Support Recovery

VP in GBs Carrier Practice, multi-year speaker at WCI and volunteer with GKTW, Caryn Siebert commented, “seeing the joy on the faces of Chris, Erin and Dinese during today’s presentation reminds me of the importance of the work we are doing directly and through WCI. Caring about our communities and supporting efforts in restoring people’s sense of normalcy is part of why I love #lifeatgallagher.”

Sedgwick’s VP of workers’ compensation practice, Scotty Benton stated, “it was great being able to share in furthering the mission of Chris and his team. The passion they show for the work they do in supporting the community and truly making a difference in their lives is amazing. It was a pleasure to be a small part of such an event. They truly exhibit Sedgwick’s philosophy of Caring Counts.”

Are you ready to crank up the excitement and make this year’s WCI conference the most unforgettable one yet? We’re bringing the energy and trust us – this is going to be an absolutely star-studded experience!

WCI is excited to announce this year’s theme: WCI Palooza – The Comp Stars Are All Here!

WCI’s Executive Director, Andrew Sabolic, shares, “Our attendees and exhibitors always look forward to the theme announcement. It sets the tone and creates an atmosphere that touches every aspect of the conference. This theme is a celebration of our industry’s workforce- those dedicated to serving the needs of injured workers, policy holders, clients, and more. At WCI, you are all Comp Stars!”

This year’s WCI Palooza theme is electric, and you’ll feel it in every corner of the conference – whether it’s at the Give Kids the World Annual Gala, our Keynote Speaker, or Monday Night’s Reception & Entertainment. The festive, vibrant theme will carry you all the way through the Exhibit Hall and into the 2nd Annual Tuesday Night Soiree. Trust us, you’ll want to be there for every moment.

This year, we’re turning up the volume with a celebration of the brightest stars in workers’ compensation. Whether you’re here to learn, network or give back, WCI Palooza is your backstage pass to a show-stopping experience, featuring:

- Star-powered keynote speakers ready to inspire and energize

- Dynamic panel discussions featuring the biggest comp stars in the industry

- Education sessions designed to level up your skills

- Networking opportunities fit for you, our VIPs, to connect and celebrate in style

And the fun doesn’t stop there! Stay tuned for more information on the Kids’ Chance of Florida Golf Tournament and other exciting events – details will be coming soon in our future WCI Spotlights.

Mark your calendar and get ready to join us this August for a chart-topping experience. The comp stars are ready to shine, and we want YOU there to celebrate with us!

We can’t wait to see you at WCI Palooza!